- Salary Sheet Template

- How To Make Salary Sheet In Ms Excel In Hindi

- How To Make Salary Sheet In Ms Excel # 43

- Salary Sheet Sample

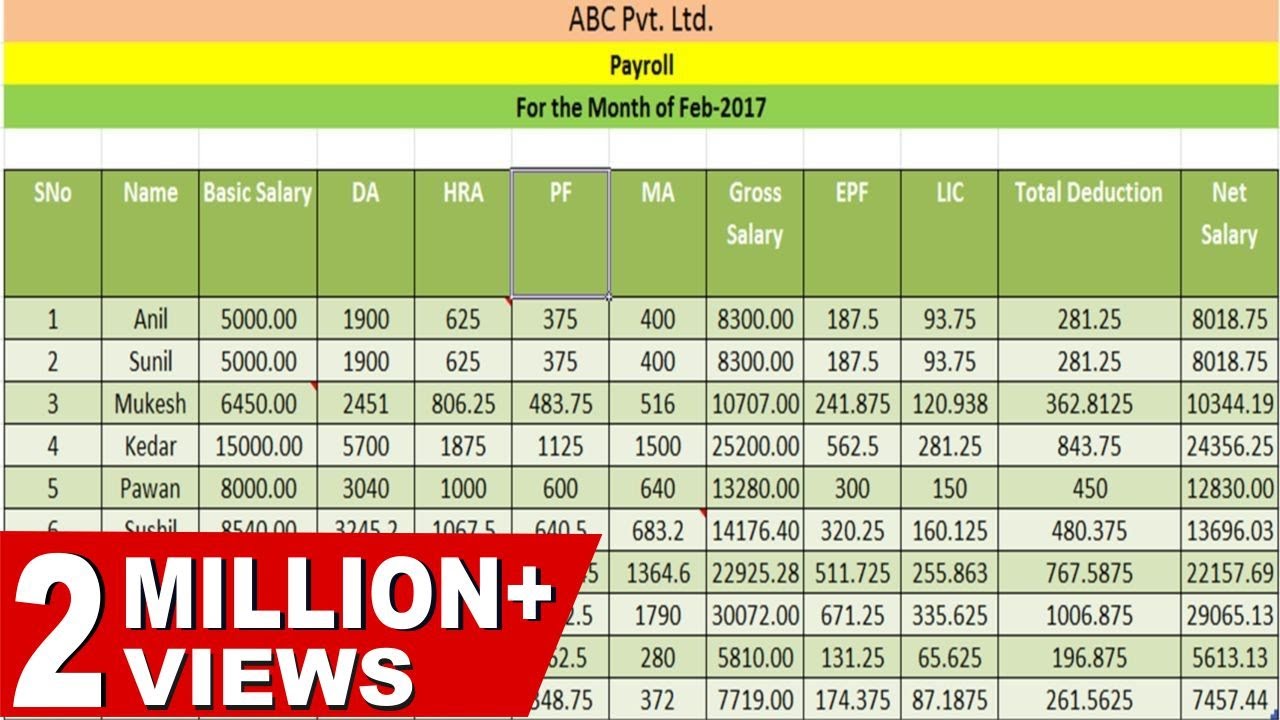

A net salary formula calculates an employee's actual take-home pay in light of gross wages and relevant deductions.

That Spreadsheet (How To Make Salary Sheet Using Microsoft Excel) earlier mentioned is branded having: Spreadsheet 15 x 40 site,How To Make Salary Sheet Using Microsoft Excel, published by means of Daniel with October 01, 2017. To see all graphics in How To Make Salary Sheet Using Microsoft Excel images gallery Spreadsheet you need to adhere to this specific url. While E3 is the excel sheet location E is the Column and 3 is the spreadsheet row Number. You can provide different percent but the formula structure shouldn’t be changed.the last 5% means all those whose basic salary below 10000 must be applied by 5%. 219430 How to create/format an Excel workbook using Visual J++ Automation 231614 How to automate Excel to create a new workbook from Delphi For more information about how to automate Excel from a HTML page, click the following article number to view the article in the Microsoft Knowledge Base. Excel Magic Trick 548: Data Validation Drop-Down List In A Cell Same Sheet or Different Sheet.

Solution:How to Create Employee Pay Sheet in Excel With Formulas. Create a new workbook in MS Excel and save as with the name Employee Pay sheet Formulas. Enter sample data for at least three employees. Enter formula for Medical Allowance = D5 * 40% in cell with cell reference E5. Download Salary Sheet Excel Template Salary Sheet Excel Template is a payroll document in which you can record payroll data for multiple employees along with Salary slip in Microsoft Excel prepared according to Indian rules of Employment which includes provident fund and employee allowances.

Collect Payroll Data

Create a new workbook in Microsoft Excel, using your own pay stub or payroll remittance advice form as a guide. Populate the sheet's columns as follows:

Because every employer is different and every state has slightly different tax rules, you'll need to identify for yourself which of your deductions and contributions are assessed before or after your taxes. Your federal tax rates may vary based on your exemptions; you can calculate your tax rates by dividing your assessed taxes against your taxable gross income from your pay stub.

Salary Sheet Template

Calculate Net Salary

How To Make Salary Sheet In Ms Excel In Hindi

Use the following formulas to calculate your net salary and other interesting financial metrics:

- Net Salary:

- Gross Salary:

- Pre-Tax Salary:

Considerations

How To Make Salary Sheet In Ms Excel # 43

Using a formula to calculate net salary makes sense if you're trying to approximate your take-home pay. However, some situations may adversely affect your calculations:

Salary Sheet Sample

- If you're paid every other week, some deductions may not apply to the third payroll in the same month. In a calendar year, there are 26 pay periods but 24 fortnights and some deductions (e.g., for health insurance) may be calculated to pull only 24 times per year.

- Watch your pay stub to identify which deductions are pre-tax or post-tax.

- Some deductions are based on a percentage of gross payroll — for example, garnishments.